The Procurement Guide to MSP Cost Models

Why your MSP cost model matters

A Managed Service Programme (MSP) can transform how you manage your contingent workforce, but only if you get the commercials right. An accurate MSP cost model is the foundation of any successful MSP procurement; it helps you compare bids on a like-for-like basis, build a credible business case for your executive board, and avoid unexpected costs once the contract begins.

Yet, many procurement teams still find cost modelling a sticking point. Data gaps, inconsistent supplier quotes, and unclear pricing structures can quickly derail your evaluation process.

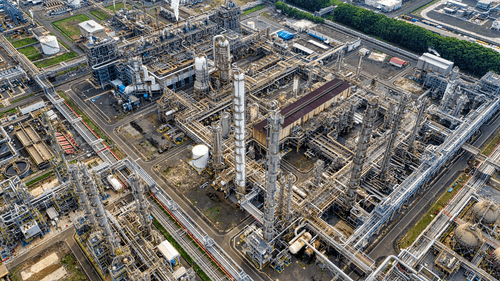

As a leading MSP solution provider for critical infrastructure businesses, we’ve supported procurement teams from leading nuclear organisations to nationwide utilities providers with their MSP pricing models. Our deep domain experience means we can balance regulatory compliance, operational resilience, and cost efficiency, helping you get work done without compromising.

We’ve created this guide to break down how to create a clear and commercially sound MSP cost model that enables effective comparisons of potential suppliers so you can make decisions with confidence and ensure contingent workforce cost savings.

Things to consider with MSP Cost Models

- How much does an MSP in recruitment typically cost?

- How much money can you save with a managed service programme?

- How to compare managed service provider cost models

- Final checklist for your procurement cost-saving strategies

- Book a cost-model review session

How much does an MSP in recruitment typically cost?

The MSP pricing models will vary depending on scope, workforce size, sector, and delivery model. MSP providers will usually charge through one of three pricing models:

- Management fee: a percentage of total spend under management (often 1–3% of contingent workforce spend)

- Supplier-funded model: the MSP is funded via a small margin agreed with the agency, meaning no direct fee for the client

- Hybrid pricing models: a blend of client fees and supplier contributions, particularly where niche or high-demand skills are involved

What’s an MSP margin?

In recruitment, an MSP margin is the percentage added by a Managed Service Provider (MSP) on top of a contractor’s pay rate. It covers the MSP’s management costs and profit for overseeing the contingent workforce.

For example:

If a contractor earns £400 per day and the MSP charges a 15% margin, the client pays £460 per day. That £60 difference is the MSP’s margin.

MSP delivery model

Delivery models will also directly influence cost and supplier relationships:

- Master Vendor: the MSP supplies most workers directly, reducing costs but limiting supplier variety

- Neutral Vendor: the MSP manages a wide network of agencies, ensuring breadth of choice but often at higher supplier margins

- Hybrid Delivery: a tailored mix of direct fulfilment and agency supply, balancing cost efficiency with niche expertise

For a deeper dive into these models and why they matter, check out our full breakdown of MSP delivery models.

How much money can you save with a managed service programme?

Depending on how mature their current model is, UK companies that use a recruitment MSP typically save 10–20% in the first year. Most of the time, these savings come from:

- Lower agency margins through managing suppliers in one place

- Clear reporting making it easier to see and control costs

- Lower risk of compliance and IR35, which means no expensive fines

- Better operations because of standardised processes and quicker hiring

How to compare managed service provider cost models

With these ten steps, you’ll be able to compare MSP costs and evaluate bids on a like-for-like basis, giving you full visibility of potential contingent workforce cost savings.

1. Start with accurate baseline data

Before you think about future savings, you need to know exactly what you’re spending today. Without a reliable starting point, you can’t measure savings, compare MSP suppliers fairly, or spot inflated costs.

Gather data on:

- Your current contingent workforce headcount

- Pay rates and charge rates by role

- Agency fees and mark-ups

- Statutory costs (holiday pay, NI, pension, apprenticeship levy)

- Screening, testing, and compliance costs

- Technology/VMS fees

- Any other pass-through costs

In our experience, the most common reason an MSP cost model fails in procurement is missing or incomplete baseline data. We regularly work with clients to fill these gaps before they go to market.

Ask your current MSP, Preferred Supplier List (PSL), or ad-hoc supply chain to provide this in writing. If you’re met with resistance, that’s already a red flag for your procurement cost-saving strategy.

2. Understand your contingent workforce profile

Your worker population profile affects almost every pricing variable in an MSP bid.

Key metrics to capture:

- Size of contingent workforce and active assignments

- Assignment duration and start dates

- Direct fulfilment % vs. 2nd tier suppliers (The percentage of workers hired directly by the MSP versus through other agencies).

- Worker source breakdown (MSP-sourced vs client-sourced/payrolled)

- Location and line manager

- Pay and statutory costs per role

This detail allows you to evaluate pricing models accurately. For example, if most of your workers are payrolled rather than sourced, an MSP supplier with a lower payroll rate may be more cost-effective than one with a slightly lower sourcing rate.

3. Build the business case

Once you have baseline data and workforce insights, you can start building your business case.

Your MSP cost model should:

- Be simple enough to present to your executive board

- Clearly show total projected savings for each bid

- Allow scenario modelling, e.g., impact of different direct fulfilment rates, tenure discounts, or tech costs

Example:

Supplier A charges a lower direct fulfilment rate but commits to only 70% direct hires. Supplier B charges slightly more but commits to 90%. Over time, Supplier B could be more cost-effective due to reduced reliance on 2nd-tier suppliers with higher mark-ups, resulting in procurement cost savings.See this in action within our E.ON MSP partnership and explore how a direct fulfilment model can reduce reliance on second-tier suppliers, improve accountability, and deliver faster, higher-quality hiring.

4. Keep the pricing spreadsheet simple

Complex spreadsheets lead to inconsistent evaluations. Procurement teams benefit most from a pricing model that captures the essentials without over-engineering.

Recommended inclusions:

- Direct fulfilment mark-up

- Payroll mark-up (for client-sourced workers)

- Tenure-based discounts

- 2nd tier supplier mark-up

- Tech/Vendor Management System (VMS) costs (priced separately)

Separating VMS costs lets you compare technology spend accurately and assess the true value of different bids. It also keeps the option open to own your own platform, giving you more flexibility and making it easier to switch MSPs in the future.

5. Clarify Mark-Up vs Margin

It’s surprising how often terminology causes confusion in MSP tenders. A 7% mark-up is not the same as a 7% margin. Why? Margins cost you more.

- Mark-up: % added to the worker’s pay rate + statutory costs

- Margin: % of the total charge rate

In simple terms, margins are calculated as a percentage of the total amount you pay (including fees and statutory costs) so you end up paying more than you would with the same percentage mark-up. Agree upfront on which you’re using and define exactly how it will be applied to avoid confusion and unexpected costs.

6. Common pitfalls in MSP cost modelling

Even the most experienced procurement teams can run into challenges when comparing MSP bids. A few small oversights at this stage can lead to big discrepancies later, either during supplier evaluation or once delivery begins.

Here are the most common pitfalls to avoid:

- Unclear or inconsistent pay rate assumptions

- Hidden tech or implementation fees

- Overstated migration savings

- Delivery model impact overlooked

- Overcomplicated pricing templates

7. Factor in contractual terms and migration costs

Migrating workers between MSP providers can appear to deliver big upfront savings but only if your contractual terms allow it.

These are important to check:

- Worker transfer clauses and associated fees

- Restrictions in existing worker contracts

- Realistic migration percentages

Treat migration savings as a one-off line item in your MSP cost model rather than building them into your ongoing projections. This avoids creating an inflated view of savings that won’t recur year after year. Always run a separate “business as usual” cost comparison without migration savings so you can see the true long-term cost picture and make more informed procurement decisions.

8. Consider temp-to-perm and permanent hire pricing

Even if your MSP engagement focuses on contingent workers, include:

- Temp-to-perm fees (broken down by tenure, e.g., 0–13 weeks, 13–26 weeks, 26+ weeks)

- Ad-hoc permanent hire fees

These can become decision-making tiebreakers if two bids are otherwise close in contingent workforce cost savings.

9. Balance MSP pricing with capability

Price matters, but it should never be the only deciding factor. An MSP provider that charges slightly more but delivers consistently high service quality, exceptional compliance standards, and faster time-to-hire will almost always outperform a cheaper alternative in real commercial terms.

We typically see procurement teams achieve better long-term value when their procurement cost-saving strategy prioritises capability and reliability over the lowest upfront cost. A cheaper MSP who can’t deliver on speed, compliance, or quality will cost more in the long run through overtime, missed deadlines, and project delays.

To ensure you’re balancing both cost savings and ability, include a technical capability evaluation alongside your cost model to ensure the supplier has the following:

- Talent pool depth and relevance

- Implementation timelines

- Technology fit and scalability

- Compliance records

Our service quality consistently ranks among the best in the industry, supported by some of the highest Net Promoter Scores in the MSP market. This means our clients not only get an MSP supplier who can deliver on paper; they work with a consultative partner who will protect their brand and maintain the standards your business depends on.

Check out a case study where we partnered with Northumbrian Water Group (NWG) to deliver a compliant, high-performing managed service programme with 100% fulfilment and real-time cost visibility, all while meeting strict regulatory deadlines.

10. Present your MSP cost model for decision-makers

Your output should be:

- A clear side-by-side supplier cost comparison

- Highlighting contractual commitments (direct fulfilment %, tech costs, temp-to-perm fees).

- Linked to business case outcomes and not just line-by-line cost.

Many leadership boards respond best to visual data. Converting cost models into simple charts can make savings and differences between MSP suppliers instantly clear.

Final checklist for your procurement cost-saving strategies

Before you finalise and sign off your MSP cost model, take a step back and make sure you have addressed every key element. This is your last opportunity to confirm that your assumptions are sound and your comparisons are fair, so your board will have all the information they need to make a confident decision.

- Baseline data complete and verified

- Workforce profile documented

- Mark-up vs margin clarified

- Tech costs separated

- Migration savings separated from BAU costs

- Temp-to-perm and permanent hire pricing included

- Technical evaluation criteria set

A well-built MSP cost model isn’t just a procurement exercise, it’ll safeguard value over the life of your MSP contract. By combining accurate data, clear pricing comparisons, and a balanced view of capability alongside cost, you’ll be able to make confident, evidence-based decisions. Your organisation can secure an MSP partnership that delivers both contingent workforce cost savings and long-term quality.

Book a cost-model review session

Get a personalised review of your MSP cost model and benchmark it against industry best practice to uncover hidden savings and unlock your full potential.

Read other MSP insights

Explore our full library of MSP resources for procurement teams navigating MSP tenders.

Visit our MSP solution page or book a discovery call to see how we can build a programme that supports your organisation's needs.