BPSS Clearance: A Smarter Approach to Background Screening

In this edition of Confessions of a Screening Expert, Jayne Lee, Head of Candidate Services at Rullion, explains what BPSS clearance involves, why it matters for high-security projects, and how her team achieves 7.5-day turnaround times without compromising compliance or candidate experience. Discover how background screening services keep critical infrastructure projects moving securely and at pace.

“What exactly is BPSS clearance, and why is it such a big deal for places like Hinkley Point C or Sizewell C?” Sibel asked at the start of our latest Confessions of a Screening Expert conversation.

It’s a good question. For many businesses stepping into regulated environments for the first time, Baseline Personnel Security Standard (BPSS) checks can feel like a maze of acronyms and requirements. But for Jayne Lee, Candidate Services at Rullion, BPSS is the baseline that keeps projects moving, and people safe.

What BPSS Clearance Involves

BPSS is the government framework for initial background screening. Jayne describes it as “the baseline of where people need to be cleared to.” It includes:

-

Right to Work check

-

Identity verification

-

Criminal record check (DBS checks)

-

Three years of employment referencing

“People sometimes call it the ‘RICE’ model,” Jayne adds. “Right to Work, Identity, Criminal record, and Employment history. It’s a clear structure, and it’s widely recognised as the entry-level clearance for high-security roles.”

From there, some roles may require higher levels of clearance (like SC or DV), but BPSS is always the starting point.

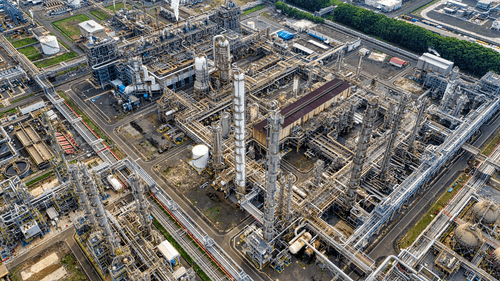

And while it’s critical at nuclear sites like Hinkley Point C and Sizewell C, BPSS clearance is increasingly required across other regulated sectors too, including rail, energy, and utilities.

The Challenge: Speed Without Compromise

At projects like Hinkley Point C and Sizewell C, every worker - from engineers to ground staff - must hold valid BPSS clearance before stepping on site. Delays here can stall entire workstreams.

The industry norm for completing BPSS checks is often 30–40 days. For major infrastructure projects, that’s simply not sustainable.

Rullion’s solution: Jayne’s team achieves an average of 7.5 days per clearance. In exceptional cases, they’ve turned around a check in just 24-hours.

But it’s not just about speed for speed’s sake.

“When you scale up, challenges appear,” Jayne explains. “Last summer we onboarded over 1,000 international workers in one intake. International criminal record checks can push timelines out, but even then, our average was around 15 days — still significantly faster than sector norms.”

Read how we deliver screening success at Hinkley Point C and Sizewell C › and see how our approach to BPSS clearance is keeping projects on track while reducing delays across complex supply chains.

More Than a System: People First

'Where does this speed come from?' asks Sibel. According to Jayne, it’s the human-led approach that makes the real difference.

Before any link or form is sent, every candidate receives a call from a named advisor.

“That first call is golden,” says Jayne. “We introduce ourselves, explain the process step by step, and make sure candidates know what documents they’ll need. If they’ve got everything ready, the process sails through.”

This proactive support avoids delays caused by missing documents or incomplete forms. And it doesn’t end there:

-

Candidates have a direct phone number and email for their advisor.

-

Clients get weekly catch-up calls to resolve issues quickly.

-

No one is left waiting on a generic helpdesk or traffic-light status update.

“It’s not just about compliance,” Jayne adds. “It’s about building trust and momentum.”

Where Technology Fits In

It’s not all down to people. Smart technology underpins the process, helping keep everything secure, visible, and moving at pace.

For candidates, that means a smoother journey with less waiting around. For clients, it means instant oversight of their workforce, so they know exactly where things stand.

“It’s the combination that works,” Jayne explains. “Automation helps with speed, but human oversight ensures accuracy, engagement, and problem-solving along the way.”

Common Challenges, Clear Solutions

Every project has its hurdles. This approach balances governance, compliance, and candidate experience all without sacrificing speed. Jayne outlines a few common ones, and how her team resolves them:

|

Challenge | Solution |

| Candidates are slow to provide documents. | Early preparation calls mean candidates know exactly what to have ready. |

| International workers require overseas checks. | Dedicated advisors manage timelines and keep clients informed, so expectations are clear. |

| Clients worry about visibility. | The portal and weekly calls ensure full transparency at every stage. |

Final Word from the Screening Expert

Jayne has spent over 13 years in background screening. Her verdict?

“BPSS clearance isn’t just a box to tick. Done right, it’s what keeps projects moving and candidates engaged. It’s about being quick, yes - but also accurate, compliant, and supportive. That’s where the human element really matters.”

For organisations, the key takeaway is clear: background screening services are most effective when they combine smart technology with a human touch.

This article is part of the Confessions of a Screening Expert series, where Sibel Akel, Marketing Director at Rullion, speaks with Jayne Lee and other industry leaders about the realities of screening in regulated sectors.

Our proven background screening services deliver fast, compliant results for high-security projects like Hinkley Point C and Sizewell C.